- Track 20 essential recruitment metrics across speed, cost, quality, and candidate experience to identify bottlenecks and optimize your entire hiring funnel systematically.

- Companies average 180 applicants per role; use conversion rates and drop-off metrics to manage volume, improve screening efficiency, and reduce candidate attrition.

- Align recruiter-hiring manager goals on key metrics like time-to-hire and quality-of-hire, then shorten feedback loops to 24-48 hours for faster hiring cycles.

- Avoid common measurement mistakes: always segment data by role/department, use real-time dashboards, and act on insights; not tracking changes negates all analytics value.

- Balance speed with quality by monitoring both efficiency metrics and long-term outcomes like first-year retention and manager satisfaction to ensure sustainable hiring success.

Hiring the right talent has always required a blend of intuition and experience. In 2024, companies averaged over 180 applicants per role, which highlights both talent abundance and hiring complexity.

That’s why tracking the right recruitment metrics is crucial. Metrics give you visibility into what’s slowing your team down, which channels deliver quality candidates, and where the process needs fixing.

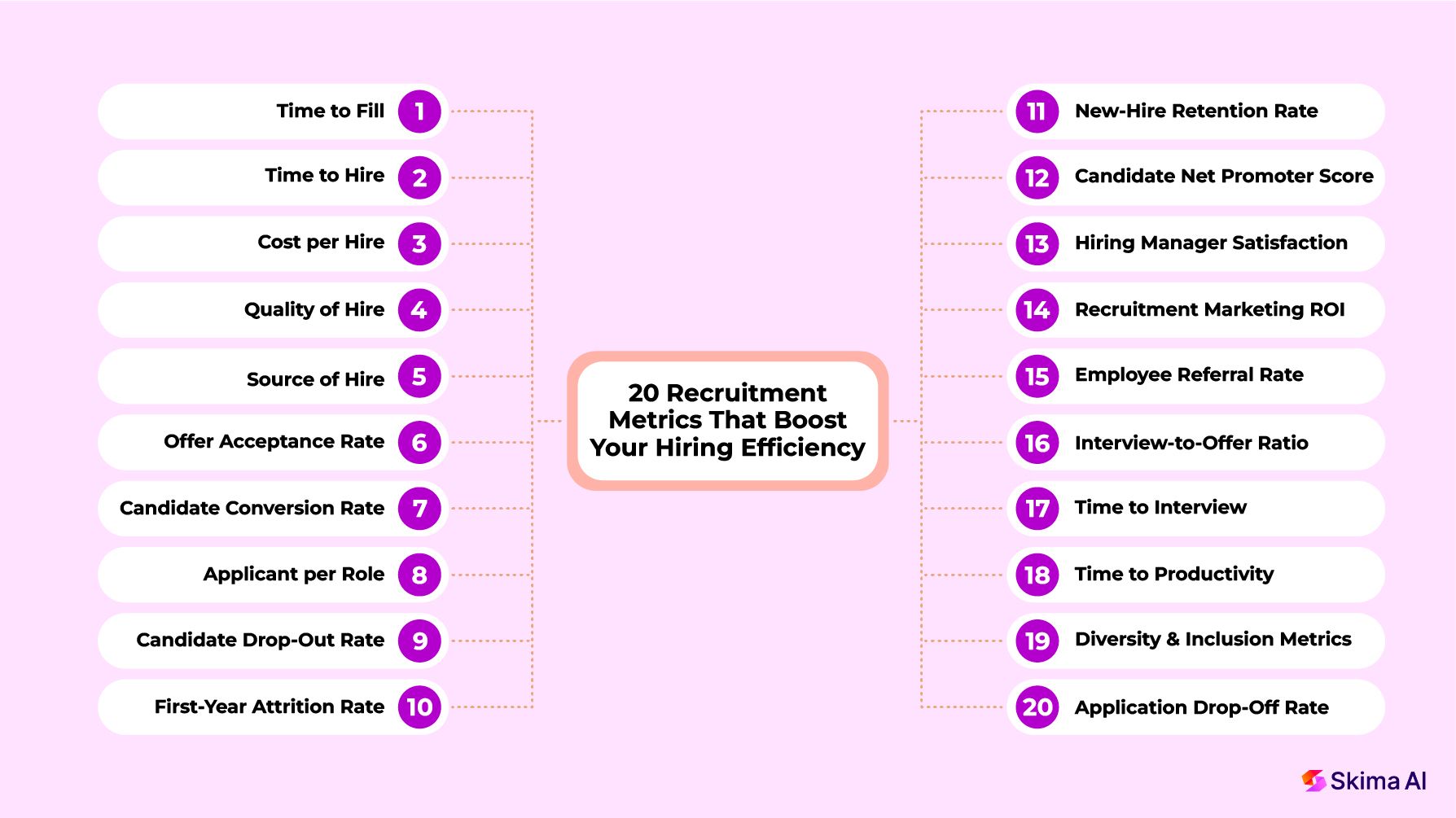

In this guide, we’ve organized 20 recruitment metrics that directly impact hiring performance. You’ll learn what each metric means, how to track them accurately, and the common pitfalls to avoid when interpreting the data.

What Are Recruitment Metrics?

Recruitment metrics are key performance indicators (KPIs) used to measure the success and efficiency of your hiring process. They provide a data-driven view of how well your recruitment strategies are performing across various stages.

By analyzing recruiting metrics, HR teams can identify valuable insights such as how long it takes to fill a position, how much each hire costs, and which sourcing channels deliver the best candidates.

They also highlight potential obstacles in your process, such as drop-offs during interviews or delays in decision-making. This allows for more informed and proactive adjustments.

20 Strategic Recruitment Metrics: Track, Calculate & Win

Recruitment metrics give you the clarity to refine your hiring process, improve candidate experience, and make data-backed decisions.

Here are the top 20 metrics in detail, what they mean, why they matter, and how to calculate them effectively.

1. Time to Fill

Time to fill measures the total duration from when a job requisition is opened until the candidate accepts the offer. It reflects your organization’s overall speed in securing talent and allows for workforce planning, particularly for time-sensitive roles.

A slow time to fill often causes productivity gaps, project delays, and employee overload. Improving this metric gives your hiring process a competitive edge in a tight talent market.

How to calculate:

Time to Fill = Offer Acceptance Date – Job Opening Date

Example: If a job opened May 1 and the offer was accepted June 10 → 40 days

2. Time to Hire

Time to Hire tracks how long a candidate spends in the process, beginning from application submission to offer acceptance. It provides insight into how efficient and candidate-friendly your recruitment process is.

Candidates often evaluate employers based on the speed of response; lengthy processes can push top talent away. Streamlining touchpoints and using tools like scheduling automation helps maintain engagement.

How to calculate:

Time to Hire = Offer Acceptance Date – Application Date

Example: Applied June 1; accepted offer June 15 → 14 days

3. Cost per Hire

Cost per Hire measures the total amount spent on recruiting. This includes internal team salaries, job postings, agency fees, and recruiting tools. The total is then divided by the number of hires.

High Cost per Hire can erode margins, especially in agencies or scaling businesses. Understanding your cost helps refine channel selection, negotiation strategy, and return-on-investment decisions.

How to calculate:

Cost per Hire = (Internal Recruiting Costs + External Costs) ÷ Total Hires

Example: $6,000 internal + $2,400 external ÷ 20 hires → $420 per hire

4. Quality of Hire

Quality of Hire evaluates new hires’ performance, retention, productivity, and manager satisfaction, often measured at 6 or 12 months post-hire.

Fast hires are only valuable if they perform well and stay. Measuring quality ensures that hiring isn’t just about speed or cost, it’s about long-term fit and impact.

How to calculate:

Quality of Hire = (Performance Score + Retention Rate + Manager Satisfaction Score) ÷ 3

Example: (80% + 90% + 85%) ÷ 3 → 85% Quality of Hire

5. Source of Hire

Source of Hire tracks the channels (e.g. referrals, job boards, social media) responsible for incoming hires. Analyzing which sources yield the best hires and fit can guide future investments.

If referrals produce high retention and performance, investing in and incentivizing referral programs delivers both efficiency and quality.

How to calculate:

Source of Hire % = (Hires from a Channel ÷ Total Hires) × 100%

Example: 30 referral hires of 100 total → 30% referrals

6. Offer Acceptance Rate

Offer Acceptance Rate shows the percentage of job offers that candidates accept compared to the number you extend. It reflects how attractive your employer brand, compensation, and hiring process are.

Low acceptance rates often point to misaligned expectations, poor communication, or market mismatches.

How to calculate:

Offer Acceptance Rate = (Offers Accepted ÷ Offers Extended) × 100%

Example: 27 accepted of 30 offers → 90% acceptance

7. Candidate Conversion Rate (Recruitment Funnel)

Conversion rates track the percentage of candidates who move from one stage to the next in the hiring funnel. This includes steps like application, screening, interviews, and ultimately, getting hired.

Low conversion at any stage indicates misalignment, perhaps unclear job postings, poor screening, or disjointed interviewing.

How to calculate:

Stage Conversion Rate = (Candidates at Stage ÷ Candidates at Previous Stage) × 100%

Example: 200 apply → 50 interviewed → 10 hired. Interview conversion = (50/200)=25%

8. Applicant per Role

Applicant per Role metric measures the average number of applicants for each open position, indicating interest and sourcing reach.

While high volume suggests strong interest, overly large applicant pools can overwhelm screening teams and dilute quality signals.

How to calculate:

Applicants per Role = Total Applicants ÷ Total Open Roles

Example: 900 applicants ÷ 5 roles → 180 applicants/role

9. Candidate Drop-Out Rate

Tracks the percentage of candidates who disengage or withdraw at various stages, including application, interview rounds, or offer stage. High rates indicate friction points in your process.

Common causes include slow communication, unclear expectations, or overly burdensome processes. Addressing dropouts improves conversion and candidate experience.

How to calculate:

Drop-Out Rate = (Candidates Lost at Stage ÷ Starting Candidates) × 100%

Example: 30 dropouts of 100 applicants → 30% drop‑off

10. First-Year Attrition Rate

Measures the percentage of newly hired employees who leave within their first year. High first-year attrition suggests problems with hiring decisions, onboarding, or company fit.

Reducing early turnover helps protect recruitment investments and build a stable, productive workforce.

How to calculate:

First-Year Attrition = (New Hires who Left in 12 months ÷ Hires that Year) × 100%

Example: 20 of 100 new hires leave → 20% attrition

11. New-Hire Retention Rate

The inverse of attrition: measures percentage of hires still with the company after a set period (e.g., 90 days or one year). Retention shows onboarding effectiveness and candidate-hire fit.

How to calculate:

Retention Rate = (New Hires Still Employed ÷ Total New Hires) × 100%

Example: 85 still after 90 days of 100 hires → 85% retention

12. Candidate Net Promoter Score (NPS)

Net Promoter Score reflects how likely candidates are to recommend your company based on their recruitment experience. NPS is a strong indicator of employer brand strength.

High candidate NPS usually correlates with positive word-of-mouth, improved applications, and stronger brand perception.

How to calculate:

Candidate NPS = % Promoters – % Detractors

Example: 70% promoters, 10% detractors → +60 NPS

13. Hiring Manager Satisfaction

Derived from feedback surveys with hiring managers, this measures satisfaction with candidate quality, communication, and recruiter support.

Aligned expectations between managers and recruiters foster smoother, faster hiring and better employee outcomes.

How to calculate:

Satisfaction Rate = (Positive Responses ÷ Total Responses) × 100%

Example: 46 positive answers of 50 responses → 92%

14. Recruitment Marketing ROI

Recruitment Marketing ROI metric assesses the return on recruitment marketing spend. It compares the value of resulting hires to the cost invested in employer branding, job ads, and events.

Optimizing ROI ensures recruitment marketing channels drive quality hires efficiently and cost-effectively.

How to calculate:

Recruitment ROI = (Value of Hires – Cost of Recruitment) ÷ Cost × 100%

Example: ₹1m in hires minus ₹200K cost → 400% ROI

15. Employee Referral Rate

Percentage of hires coming through employee referrals, generally higher performing and longer‑staying hires with cultural fit advantage.

A strong referral pipeline also suggests positive internal perception and employer branding.

How to calculate:

Referral Rate = (Referral Hires ÷ Total Hires) × 100%

Example: 15 referrals of 60 hires → 25%

16. Interview-to-Offer Ratio

Shows how many interviews need to be conducted to extend one offer. Lower ratios signal efficient screening and better alignment between role and candidate pool.

High ratios often point to ineffective job descriptions, overly broad sourcing, or poor interviewer calibration.

How to calculate:

Interview-to-Offer Ratio = Total Interviews ÷ Total Offers

Example: 60 interviews, 10 offers → 6:1

17. Time to Interview (Speed of Response)

Tracks time between application submission and first interview invitation, showing how fast you engage candidates. Prompt responses improve candidate experience and reduce drop‑outs.

Slow response times frequently lead to candidate disengagement or acceptance of other offers.

How to calculate:

Time to Interview = Interview Invite Date – Application Date

Example: Applied Mar 1, interview invited Mar 3 → 2 days

18. Time to Productivity (Ramp-Up Time)

Measures how many days it takes for a new employee to reach full productivity, indicating onboarding and integration effectiveness.

Fast ramp-up means less downtime and quicker ROI on new hires, particularly critical for technical or revenue-driving roles.

How to calculate:

Time to Productivity = Full Productivity Date – Start Date

Example: Started Jan 1, full productivity by Apr 1 → 90 days

19. Diversity & Inclusion Metrics

D&IM monitors demographic representation (gender, ethnicity, etc.) at different recruitment stages, from applications to hires, to ensure inclusive hiring practices and reduce bias.

Progressive organizations use this data to assess DEIB goals, demonstrate accountability, and foster diverse teams.

How to calculate (by group):

% Hires from Group = (Hires from Group ÷ Total Hires) × 100%

Example: 20 hires from underrepresented groups of 80 total → 25%

20. Application Drop-Off Rate

This metric shows the percentage of candidates who start the application but fail to complete it. A high drop-off rate may point to poor user experience or overly complex forms in your ATS.

Lowering this rate can result in more completed applications and a stronger, more engaged candidate pool.

How to calculate:

Drop-Off Rate = (Started Applications – Completed Applications) ÷ Started × 100%

Example: 100 start, 40 complete → 60% drop‑off

These metrics provide a full view of speed, cost, quality, experience, and diversity. They help you build a smarter, more competitive recruitment strategy for 2025.

6 Best Practices for Hiring Managers to Improve Recruitment Metrics

To get the most out of your data and improve hiring outcomes, hiring managers need to go beyond surface-level numbers. Here are six best practices to help you use recruitment metrics effectively and make data-driven hiring a reality:

1. Align with Recruiters on Key Hiring Metrics

Sit down with your recruitment team and decide which hiring metrics matter most for each role. Whether it's time to hire, quality of hire, or offer acceptance rate, alignment ensures everyone is working toward the same goals.

2. Understand the Story Behind the Numbers

Don’t just look at dashboards. Dive into what your recruiting metrics reveal about candidate behavior, process bottlenecks, and the effectiveness of your screening criteria.

3. Use Data to Improve Interview Quality

Track interviewer performance and calibration using structured scorecards. This helps reduce bias and creates consistency in how candidates are evaluated, which improves overall talent acquisition metrics.

4. Shorten Feedback Loops

Delayed hiring manager feedback slows down the entire process. Set a standard to submit evaluations within 24–48 hours post-interview to reduce time to hire, one of the most critical talent acquisition metrics.

5. Review Funnel Conversion Rates Regularly

Observe how candidates move through your hiring funnel to find and fix weak points quickly. This approach makes recruitment metrics more useful and improves your ability to predict future hiring needs.

6. Act on Candidate Feedback

Candidate surveys offer direct insight into your employer brand and candidate experience. Use this feedback to tweak your process and improve key talent acquisition metrics like Net Promoter Score and application completion rate.

When these methods are applied well, hiring metrics can direct strategic improvements and help create stronger teams quickly.

7 Common Mistakes When Measuring Hiring Metrics

Even with access to robust recruitment data, various organizations fall into common traps when measuring performance.

Misinterpreting or misusing HR recruitment metrics can lead to poor hiring decisions and missed improvement opportunities. Here are the top mistakes to avoid:

Tracking Too Many Metrics Without Purpose

Collecting data for the sake of it clutters decision-making. Focus only on key recruitment metrics that align with your goals that are mentioned above.

Ignoring the Context Behind the Numbers

Numbers don’t tell the full story. For example, a high time to fill may not be bad if you're hiring for a niche role. Understanding the context is crucial when reviewing hiring metrics examples.

Not Using Real-Time Data

Outdated recruitment data leads to delayed decisions. Real-time dashboards and automated reports help you spot trends early and act quickly.

Overlooking Candidate Feedback in Metrics

Many teams ignore candidate surveys when evaluating HR recruitment metrics, but this data offers rich insights into your hiring process and employer brand.

Failing to Segment Data by Role or Department

Aggregated recruiting analytics may mask performance issues in specific teams or roles. Always segment metrics by department, job level, or location for deeper insights.

Measuring Outputs, Not Outcomes

Tracking how many interviews were done is useful, but understanding how many of those led to successful hires is more important. Focus on hiring metrics examples that measure impact, not just activity.

Not Acting on Insights

The biggest mistake? Measuring everything and changing nothing. Use key recruitment metrics to drive discussions, optimize your funnel, and improve quality over time.

Summary - Start Tracking Key Hiring Metrics

In 2025, successful hiring is about clarity, consistency, and action. Tracking the right recruitment metrics helps you move beyond guesswork and toward smarter, more predictable hiring outcomes.

Tools like Skima AI make this process easier. With real-time dashboards, smart automation, and deep analytics, Skima AI helps you not only track essential metrics but also act on them.

When you're looking to reduce time-to-hire, improve candidate experience, or build a more inclusive hiring funnel, Skima AI helps you make every second count.

Frequently Asked Questions

1. What are recruitment performance metrics?

Recruitment performance metrics are data points used to assess how effectively your hiring team meets its objectives. These include metrics like time to hire, cost per hire, quality of hire, and offer acceptance rate. Tracking these helps you evaluate the efficiency, cost-effectiveness, and impact of your recruitment strategy.

2. How do you measure recruitment effectiveness?

To measure recruitment effectiveness, track both efficiency and quality-focused KPIs, such as time to fill, first-year attrition, source of hire, and candidate satisfaction. Compare these metrics over time, against industry benchmarks, or across departments to identify patterns and improvement areas.

3. What is a recruitment metrics dashboard?

A recruitment metrics dashboard is a visual reporting tool that displays real-time hiring data in one centralized place. It typically includes key metrics like funnel conversion rates, cost per hire, and diversity ratios. Dashboards make it easier for HR and hiring managers to spot trends, monitor performance, and make data-driven decisions.

4. What are the most important metrics for talent acquisition?

Essential metrics for talent acquisition include time to hire, cost per hire, quality of hire, candidate NPS, sourcing channel efficiency, and diversity of hires. These metrics help measure the success of both your short-term recruitment campaigns and long-term hiring strategy.

5. What are staffing metrics, and how do they differ from recruitment metrics?

Staffing metrics refer to KPIs that measure broader workforce planning and fulfillment, like fill rate, vacancy rate, and contractor conversion. While recruitment metrics focus on the hiring process, staffing metrics reflect operational efficiency in ensuring roles are filled promptly with the right talent mix.